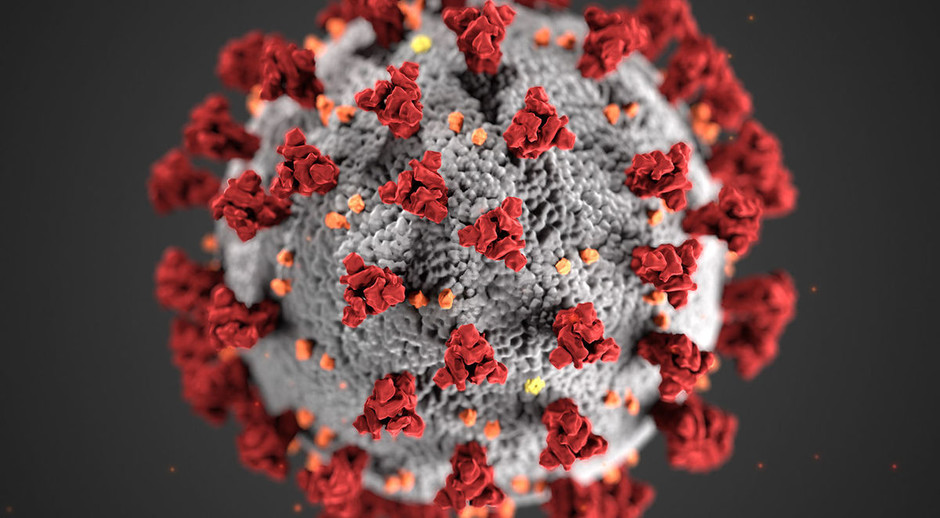

Eastern Mediterranean University (EMU), Business and Economy Faculty, Banking and Finance Department Chair Prof. Dr. Nesrin Özataç, published an article titled “Coronavirus Crisis and Behavioural Economy – 1”. Beginnning her article with the question “how rational are you?” Prof. Dr. Özataç continued with the following comments: “The inevitable reality of the Coronavirus (Covid-19) suddenly entering our lives and threatening our health, the economic, social, spiritual and many more effects that it brought with it, have been the main agenda of individuals, societies and countries.

“Behavioural Economy and Financial Approaches have Gained Importance”

The inevitable truth is the sudden existence of the corona virus in our lives. It not only brought a threat on our health but also on our economy, psychology and many other effects on individuals, communities and countries. The negative effect of Covid-19 on the countries’ economy, decrease in income level and shrink in the countries’ economies . The pandemic has triggered a severe economic crisis. In the recent IMF report, it is discussed that the World Economic Global outlook is to shrink by 3%. During the period of crises , the uncertainty is exceptionally high. Thus making the case difficult to be explained by economic theories. It is so common to encounter with articles written on the fall of the Neo-liberalism. The pandemic is considered as the most severe crises after the World World II. In this respect, the approach of behavioral economics and finance gain importance in making future economic plans. Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals and institutions. Behavioral economics is primarily concerned with the bounds of rationality of economic agents.

“A Rational Person refers to homo economicus making desicion that result in the optimal level of benefit or utility”.

Behavioral economy argues that people do not always act "rationally" in making economic decisions, and that decision making is made under the influence of many social, cultural and psychological influences, and that economic policies should be designed with considering those factors. These policies can be on a company or individual or even state or interstate level. As in other disciplines, economists try to solve and examine problems by developing economic models. The standard model of human beings (homo economicus) accepts that people are "rational". The rational person does not indicate that the a person simply make desicions on his or her benefit , rather the "rational" person is the being who can use the information that is “available” according to his or he preferences. Moreover, while making choices some factors are taken into consideration such as happiness of other people, a desire for a fair income distribution and protection of nature. At this point, the aim of economists is to discipline the appropriate structure in line with the information and preferences available. In n the literature of both economics and psychology , there are numerous examples where people do not act rationally with systematic deviations from rationality.

Limited Rationality

It has been proved by various studies that human beings cannot be rational during the times of uncertainties. Keynes, for example, emphasizes that human beings act impulsively without thinking, especially when there is a lack of information. In 1955, Herber Simon (counted as the pioneer of behavioral economy) argued that individuals have full knowledge yet limited cognitive abilities, and as a result of this, the possibility of taking more wrong steps when facing with complex problems. The concept of ‘rational individual’ should be replaced with ‘limited rational individual’. The 'limited rationality' was also used by Richard Thaler, who won the Economics Nobel Prize in 2017. Richard Thaler analysed their behavior in light of the behavioral data, developed economic policy and registered a new approach to the concept of behavioral economics. In his book, Nudge, Thaler has turned his research into what he calls “nudge”, with small changes in the behavior framework that will enable people to make better decisions, that is, to increase well-being. The dictator game he developed with Thaler, Knetsch and Kahneman is quite interesting.

I would like to talk about this game briefly. In this game, two players that do not know each other and will never see one another again are playing, and one (dictator) is given some money and is asked to divide it between the two of them. The second player has no right of word in this. The expectation is that only a self-thinking decision-maker will take all the money away. The surprising result is that most of the people give some of the money to the other player, and even many “dictators” share the money as even. It can be concluded that people can make decision even if it is against their own interests, as long as there is a an understanding of fair distribution and justice.

Effects of Crisis Period

With the upcoming of Corona Crisis period, the country leaders decided to apply a reduction in the salaries to public sector employees proportionally among high-income and low-income people, as well as retired civil servants. It can be observed that, as long as ensuring the justice that there was no contradictory reaction among the servants. Many of Thaler’s work is confirmed during the corona crisis period, as people show no reaction to price changes (effects of oil prices and currency fluctuations) and reasonably accept , however, protest the price increases due to demand (increase in cologne and mask prices etc.) displaying that people make protest to unjust adjustments.

Restructuring of the economy is inevitable as a result of the Covid-19 crisis. The sectors, where production and employment losses are mostly experienced, should be separated rationally in order to reduce economic and social losses. It is essential that there is a need of an implementing a plan through the methods of economical methodologies without ignoring the behavioral economy; thus concerning justice, psychological as well as cultural factors.